Best Dabba Trading Platform in India

Enjoy Maximum

Profits with

ZERO BROKERAGE

Get a 3-Day Free Demo Account for Dabba Trading.

Is money-making your passion? Our platform makes trading easy and fun. Trade anytime, anywhere.

Zero Brokerage

24/7 Deposit & Withdrawal

Upto 500x Margin

24/7 Call Support

About Dabba Trading Platform

Welcome to the Best Dabba Trading Platform where we empower investors to easily customize their portfolios. Our platform provides easy access to a wide range of markets, including stocks, cryptocurrencies, commodities and indices.

5,000

Trusted Traders

10 cr.

Brokerage Saved

10

Years of Legacy

24/ 7

Instant Support

500x Leverage

You can start share trading with low margin and get 500 leverage for day trading.

Instant Withdrawal

We will provide instant withdrawal.

24x7 Call Support

We are available 24×7 if you stuck any point of time during taking trading or any transaction then contact us.

Lowest Brokerage

We are providing lowest brokerage in industry

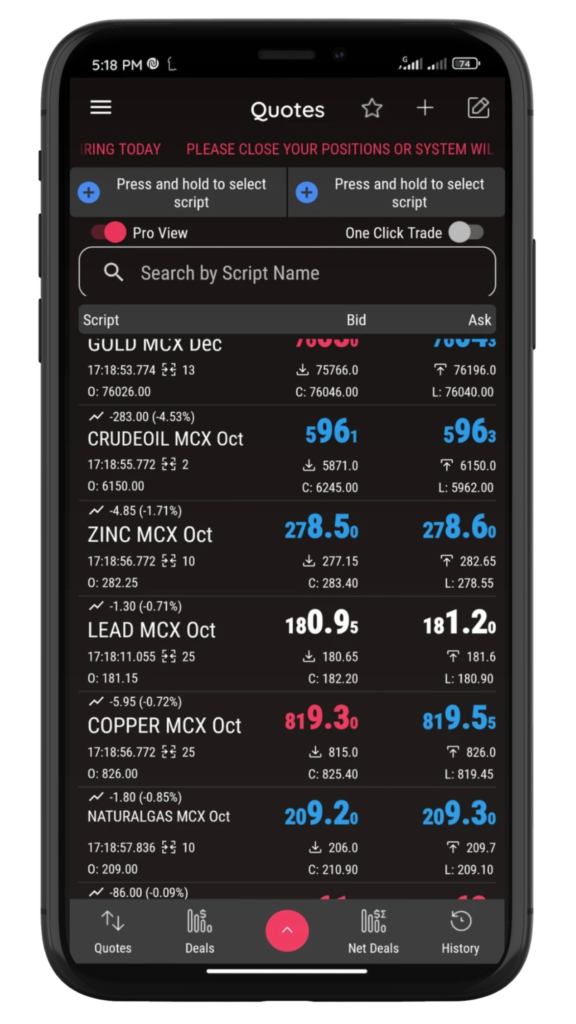

Easily Managable account

We provide hassle free trading app which is easy to use.

Tax Free Trading

You can start share trading with low margin and get 500 leverage for day trading.

How Our Dabba Trading Provides Value

- Zero Brokerage Fees

- 500x Leverage

- 24/7 Call Support

- 30-Min Instant Withdrawal

- 0% Tax & Commission

- 60x Holdings Margin

- Hassle-Free Trading

Dabba Trading Platform Services

NSE

A leading hub for equities and derivatives trading.

MCX

Expertise in metals and agricultural commodity derivatives trading.

NCDEX

Leading in agricultural commodity trading within India.

FOREX

A leading hub for equities and derivatives trading.

CRYPTO

Dynamic platform for Bitcoin and Ethereum trading.

COMEX

Renowned for precious metals futures within NYMEX.

Support Whenever You Need It

Our 24×7 customer support ensures you’re never alone,

and your deposits and withdrawals are always smooth and efficient.

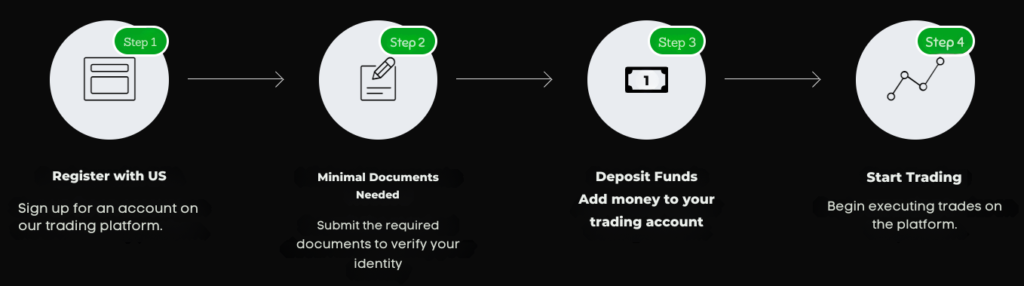

Open Account in Just 1 Minute and Start Trading

Keep in Touch!

Fill the form soon, Waiting...

Church gate,Mumbai 54785 India

+919967171293

support@skytrade.co.in

Thank you for joining us on the path to financial empowerment and embracing the transformative power of blockchain technology!

What Is Dabba Trading in India?

Dabba Trading also known as box trading or bucket exchange, represents an age-old practice in Indian banking. Because of its urban origin, it operates outside the formal market, creating irreplaceable trade. Despite the historical facts, regulators like the Securities and Exchange Board of India (Sebi) consider such trading illegal. However, it is still used by traders looking for quick financial returns.

This unconventional business model offers many advantages depending on the operator or platform involved. With lower fees, can trading systems make it easier for traders to make a profit. They offer significant intraday margin ratios of up to 500X, enabling traders to maximize profit opportunities on a single trade. Additionally, these platforms extend up to 60X margins for carry-forward positions, typically requiring minimal paperwork to initiate trading, thus avoiding taxes and other fees

The advent of electronic share certificates in 1996 gave the economy a huge boost. By consolidating all existing certificates into a digital demat account, management and trading of savings, shares, mutual funds, bonds and ETFs has become a simple Demat account that acts as a digital repository to facilitate transactions and it increases the range of financial instruments available.

Dive into the dynamic world of Best Dabba Trading Platform in India’s

Indian financial markets are alive with opportunity, and stock trading is at the center of this excitement. Among the various marketing strategies, can marketing has risen as the fastest and most distinctly growing channel. Let’s take a closer look at what makes the best dabba trading in india unique and why it is attracting so much attention.

Why do you Need a Demat Account?

Having a Demat Account is essential in today’s digitized financial environment. As investments, trading and record keeping have shifted to the digital realm, the Demat account provides a centralized way to manage financial assets

Digitizing demat accounts offers a number of added benefits, including ease of management, greater transparency in trade and transactions The use of digital certificates reduces the risk of non-certification true or is duplicate significantly under, and ensures the accuracy of the budget

Like bank accounts, each Demat Account is assigned a unique account number, simplifying the process of holding and managing shares and securities. Additionally, account holders receive monthly statements of their balances, electronically or through traditional forms, allowing them to track and manage their investments

Essentially,Demat Account are a safe and accessible platform for investors to navigate today’s complex financial markets.

How Does Dabba Trading Work

The strategy behind Dabba trading is simple and efficient. A trader places an order based on the movement of a stock’s price without the actual trade taking place on a registered exchange. For example, a trader might choose to “buy” a stock at a certain price. If the stock price increases, the trader profits from the difference between the two prices.

This allows traders to benefit from price movements without having to go through the often complex and time-consuming procedures of formal exchanges. With the right approach, traders can take advantage of small fluctuations to gain significant profits.

Why Are There No Brokerage Charges in Dabba Trading

One of the most attractive aspects of Dabba trading is the absence of brokerage charges. Traditional exchanges usually involve fees that can eat into your profits, but Dabba trading platforms typically do not impose these fees. This creates an accessible trading environment for anyone looking to minimize costs and maximize returns.

Because no official exchange is involved, traders can focus solely on the market and their strategies, without having to worry about additional expenses.

What Are the Advantages of Dabba Trading?

Dabba trading offers several benefits that make it appealing to a wide range of traders:

- No Brokerage Fees: By eliminating brokerage charges, Dabba trading allows traders to keep a larger portion of their profits.

- Faster Transactions: Since trades are not routed through traditional exchanges, transactions can be completed quickly and efficiently.

- Flexibility: Traders can easily capitalize on market movements without worrying about margins, documentation, or formal exchange processes.

- Profit Potential: With the right market knowledge, traders can benefit from even minor price fluctuations.

- Private Trading: Dabba trading gives traders the flexibility to manage their investments privately and discreetly, offering a unique trading experience outside traditional systems.

How is Dabba Trading Settled?

In Dabba Trading transactions are usually settled on a weekly basis. The broker facilitates the trades based on the agreed-upon stock prices, and profits or losses are settled between the trader and the broker. This system provides a smooth and efficient way to conclude trades, allowing for quick profit realization and portfolio management.

In 2024, the Dabba Trade Fairs

- MCX is used

- NSE and it is

- Their choice is work

- FOREX

- COMEX is used

- Crypto coding

Dabba trading works like traditional trading practices but offers more advantages and benefits. Dabba merchants acting as intermediaries must keep physical records of their clients’ transactions, which must account for inflation. Trade is settled on the basis of price differences between orders and sales, not actual trades on recognized exchanges.

Despite the perceived risks and regulations, the bottle trading industry is attractive to investors for several reasons:

- Lower costs: Can business generally requires lower costs compared to traditional production methods. Traders operating outside of regulated banks avoid transaction fees and other fees associated with routine trading.

- Leveraged trading: Can trading enables traders to leverage their investments by taking advantage of margins provided by operators. This enables them to maximize potential gains and losses by investing only a fraction of the total trading value.

- Anonymity: Trading through can brokers provides some privacy for investors who want to keep their identity and trading activities private. A few documents are needed to get you started, and to keep their names.

- Flexibility: Can management provide traders with different options for stocking, timelines and trading tools. This freedom allows investors to diversify their portfolios without being restricted by banking regulations or trading hours.

- Quick Settlement: Unlike traditional transactions, where the settlement process can take up to two days, can trades are settled within a day, sometimes even in cash.

Despite these advantages, it is important to acknowledge the fundamental risk of the bottle industry. By operating outside of legal banks, traders face the possibility of fraud, manipulation and financial loss. Engaging in illegal trade can also have legal implications and damage its financial reputation.

In conclusion, while can trading offers many advantages such as cost savings, leverage and flexibility, investors should conduct careful and thorough research before venturing into this unconventional venture in order to understand the risks and make informed decisions.

How Safe Is Dabba Trading?

Dabba trading carries inherent risks for investors, and requires careful research and caution before venturing into it. Before dealing with any broker, company, or can operator, investors should do extensive due diligence to ensure reliability and credibility.

It is important to note that can trading operates outside of regulatory oversight, exposing investors to potentially deceptive and unethical business practices. Without the protection offered by regulated banks, investors can be vulnerable to manipulative transactions and lose money.

While can trading can provide attractive profit opportunities, it is important for investors to prioritize risk management and remain vigilant in this unconventional trading environment

Is Dabba Trading profitable?

Despite the controversy, if managed prudently, can business be profitable.

One of the key advantages of trading continuity is that traders can profit from market movements without owning the underlying assets This means that traders can exploit the price discrepancies to maximize profits, without committing capital . . . .

Additionally, can trading offers greater flexibility and speed compared to traditional trading methods. Traders can place orders quickly, allowing them to take advantage of market fluctuations and trade at their convenience.

In addition, the can trade provides access to otherwise inaccessible or restricted markets. This creates opportunities for traders to make their portfolios and can increase their profits.

However, it is important to acknowledge that there are inherent risks in the bottle business, as with any business. Success in the bottle industry requires diligent research, disciplined risk management and staying abreast of market trends.

In conclusion, while bottle trading can provide profitable opportunities for savvy traders, it is important to approach it with caution and discipline to minimize risks and maximize returns

What is the Dabba Trading Strategy?

In dabba trading, the strategy revolves around making bets on the price movement of a security without actually placing an order on a recognized exchange. The operator of the dabba trading platform records the transaction off the books, and the trade is settled based on the difference between the quoted price and the actual market price at the time of settlement.

If the market price moves in favor of the trader’s bet, they profit from the difference. However, if the market moves against them, they incur a loss, which is also settled directly with the operator. This entire process bypasses the legal framework designed to protect investors and ensure transparency in trading activities.

What are the Disadvantages of Dabba Trading?

Dabba trading carries numerous disadvantages, primarily due to its illegal and unregulated nature. Since the transactions are not recorded on any official exchange, traders have no legal recourse in case of disputes.

The lack of transparency makes it difficult for participants to track their trades, manage their finances, and assess the true risks involved. This can lead to substantial financial losses and other serious consequences, including legal troubles. Additionally, since dabba accounts are off-the-books, traders are vulnerable to fraud and misconduct by the operators.

What are the Rules of Dabba Trading?

Dabba trading operates in the shadows of the legitimate financial market, using the prices of commodities or securities as benchmarks without adhering to the rules and regulations that govern recognized exchanges.

Participants in dabba trading are often not required to put up a margin to trade, and contracts are typically settled on a weekly basis.

The operator of the dabba platform earns a small fee from both the buyer and the seller for facilitating the trade. However, because this form of trading is illegal, it does not provide any protection to the traders involved.

What is the Penalty for Dabba Trading?

Engaging in dabba trading is a serious offense under Indian law. Beyond its violation of securities laws, dabba trading also falls under the purview of Sections 406 (criminal breach of trust), 420 (cheating and dishonestly inducing delivery of property), and 120-B (criminal conspiracy) of the Indian Penal Code, 1870.

If convicted, individuals involved in dabba trading can face imprisonment for up to 10 years, a monetary penalty of up to ₹25 crores, or both. The severe penalties underscore the risks and illegality of participating in such activities.

Why is Dabba Trading Illegal?

Dabba trading is illegal primarily because it circumvents the regulatory framework designed to protect investors and maintain the integrity of the financial markets. Participants in dabba trading are exposed to significant credit risks, as there is no guarantee that the operator will honor their commitments.

If the operator defaults or becomes insolvent, traders may lose all their invested money without any recourse. Furthermore, dabba trading undermines the trust and transparency that are crucial to the functioning of legitimate markets, making it a dangerous and illegal practice.